As governments around the globe roll out innovative policies to boost green energy investment, the passing of the 2022 Inflation Reduction Act (IRA) in the United States now makes it far easier for businesses to optimize their tax strategy by investing in clean energy.

While renewable energy developers earn Investment Tax Credits (ITCs) for investing in certain types of clean energy projects, most don’t earn enough taxable income to utilize these credits fully. The IRA offers companies in the green sector a way to monetize their unused ITCs.

For the first time, these developers can transfer the ITCs to tax-paying corporations without the hassle of traditional tax equity partnerships.

The Inflation Reduction Act has now changed the tax landscape. CFO Dive spoke with Bellus Ventures and Thompson Coburn LLP to understand the steps that CFOs can take to stay ahead of the curve on clean energy investments.

The old way: Tax equity partnerships

Renewable energy developers have always needed creative ways to monetize the tax benefits associated with renewable energy projects. The “Tax Equity Partnership” emerged as a way for renewable projects to funnel most of their tax benefits to a “Tax Equity Investor” in lieu of cash. Unfortunately, tax equity deals are complex, expensive to underwrite, and do not meet the hurdle rate for most corporations.

“Tax equity deals typically yield 10-12% and tie up capital for at least 5 years,” says John Sinclair, Managing Director at Bellus Ventures, an environmental markets firm. “For a bank, that’s a great return. For most non-financial corporations, a tax equity deal isn’t competitive with other investment opportunities.”

Tax equity deals can also be complicated due to partnership structures. “Renewable energy projects carry various risks, require knowledge of complex tax rules, and an investor commitment for the duration of the relevant recapture period,” said Nicholas Kappas, Partner at Thompson Coburn LLP, a national law firm that advises clients on renewable energy and other tax credits. “The tax equity investor must be cognizant of such risks throughout the first five years of the project’s operations. As a result, structuring a tax equity deal properly to avoid problems down the road adds significant time and cost.”

The new way: ITC Transfers

The 2022 Inflation Reduction Act allows ITCs generated by renewable energy projects to be sold without any complicated partnership structures. “Transferability” leads to higher returns, increased flexibility, and reduced structuring costs versus the old tax equity model. However, benefiting from ITC transfers requires an in-depth understanding of the Act, access to qualified developers, and tools and tactics to maximize return and mitigate risk.

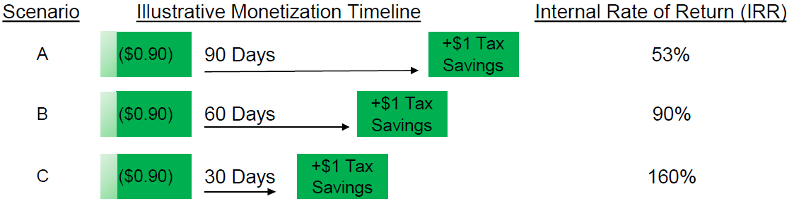

“The ITC transfers have a short payback period,” says Ian Clark, Advisor at Bellus Ventures. “If used against estimated taxes, an ITC transfer can monetize within 90 days for an Internal Rate of Return (IRR) over 50%. ITC transfers compete with short-term investments like treasury bills and not a corporation’s long-term capital program.”

The short payback period for ITC transfers also gives CFOs a lot of flexibility. Sinclair notes that CFOs can decide quarter by quarter how much ITC they need to buy without making a five-year investment commitment.

“Properly structured, an ITC transfer can be a much simpler transaction than a tax equity partnership and therefore less costly,” says Mariquita Barbieri, Partner at Thompson Coburn LLP. “Many smaller projects that couldn’t afford the legal overhead of a tax equity deal may find ITC transfers attractive.”

Tax Equity vs. ITC Transfers

| Old: Tax Equity | New: ITC Transfers |

| • Primary way to monetize ITCs prior to the Inflation Reduction Act (IRA). | • New option created by the Inflation Reduction Act (IRA): Direct ITC transfers by sale weren’t possible prior to 2023. |

| • Multiyear payback period. | • Short payback period: Can be monetized within 90 days. |

| • Low Internal Rate of Return (IRR). | • High Internal Rate of Return (IRR): Short payback can result in IRRs above 50%. |

| • Tax investor takes an equity stake in a project for 5+ years. | • No equity stakes, no long-term partnership exposure for buyers. |

| • High structuring costs; only suitable for large projects. | • Low structuring costs; appropriate for a much larger universe of projects. |

| • Tax investor can use project depreciation. | • ITC buyer cannot use project depreciation. |

Source: Bellus Ventures

How to get started

While ITC transfers are simpler than tax equity deals, they still require experience to execute properly. “The Bellus value proposition is that we make the process easy,” said Clark. “We have a deep bench of experienced professionals, a broad network of vetted developers, and we can structure the right deal for every buyer.”

For more information, contact Bellus Ventures at ITC@bellusventures.com.