Many CFOs have made improving their corporate ESG profile a priority, but an environmentally responsible strategy that also increases profits can seem too good to be true.

That’s where Investment Tax Credit (ITC) transfers come in. ITC transfers, made possible by the Inflation Reduction Act of 2022, are a strategic way for corporations to support renewable energy and save money on taxes.

CFO Dive spoke with Bellus Ventures, an investment firm focused on environmental markets, about the new ITC market.

Overview of the Investment Tax Credit (ITC)

The Investment Tax Credit (ITC) is a federal income tax credit earned by developers of renewable energy projects, such as solar and wind power plants, grid scale batteries, and other clean energy technologies. An ITC is earned when a renewable project enters service.

Most renewable energy developers do not pay enough taxes to use ITCs themselves. While unused ITCs can be carried forward, most developers need cash now to pay off debt and invest in new projects. Historically, monetization of ITCs was only possible via complex tax equity partnerships dominated by a limited number of large banks.

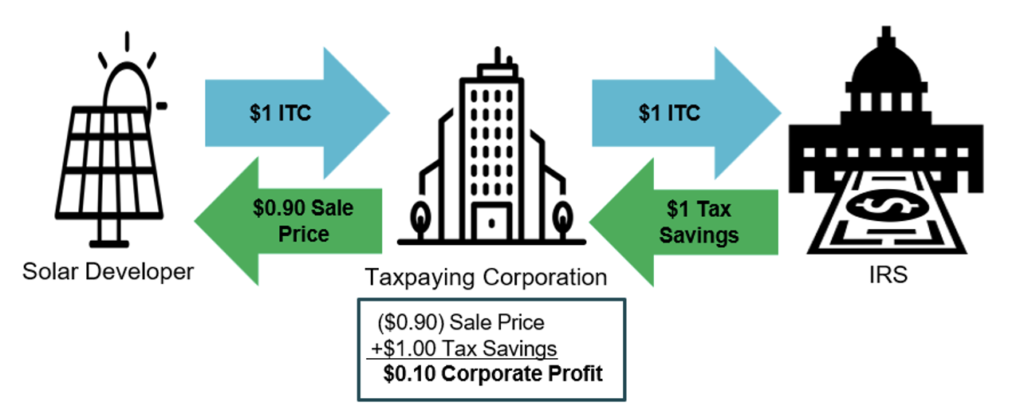

The Inflation Reduction Act created a new option: ITC transfers. With an ITC transfer, renewable energy developers sell their ITCs to taxpaying corporations. The developer receives cash immediately, and the corporation earns a locked-in profit by buying at a discount to par.

“There is a tidal wave of renewables under development, but it all hinges on CFOs and corporate treasurers realizing the opportunity that Congress has handed them,” said John Sinclair, Managing Director at Bellus Ventures. “Corporate ITC buyers are essential for any renewable developer to make the numbers work.”

How corporations can use the ITC

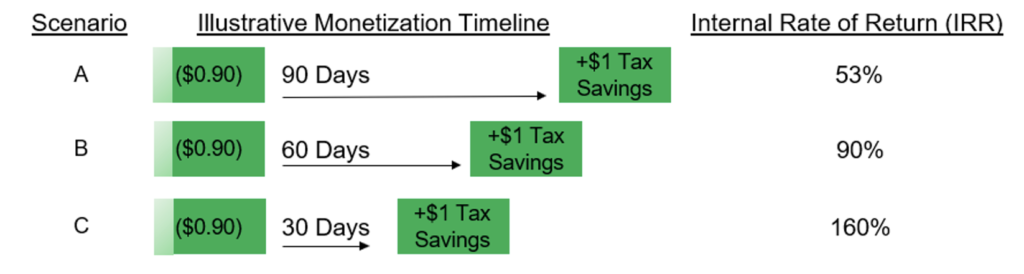

“There are multiple ways for corporate buyers to achieve high returns with ITCs,” says Corbin Wood, Analyst at Bellus Ventures. “The easiest way to monetize ITCs is by reducing current tax liabilities, such as quarterly estimated taxes. Purchasing ITCs close to a payment deadline results in a very high Internal Rate of Return (IRR).”

Corporations can also use ITCs for carryback returns requesting refunds of taxes paid within the last three years. An ITC could be carried forward up to 22 years, although carrying forward is net present value inefficient.

Widely held C corporations are ideal ITC buyers and can use ITC for up to 75% of their total federal income tax liability. Partnership, pass-thru, or closely held entities will have a much tougher time using ITCs due to IRS regulations.

ITC market to grow with renewable buildout

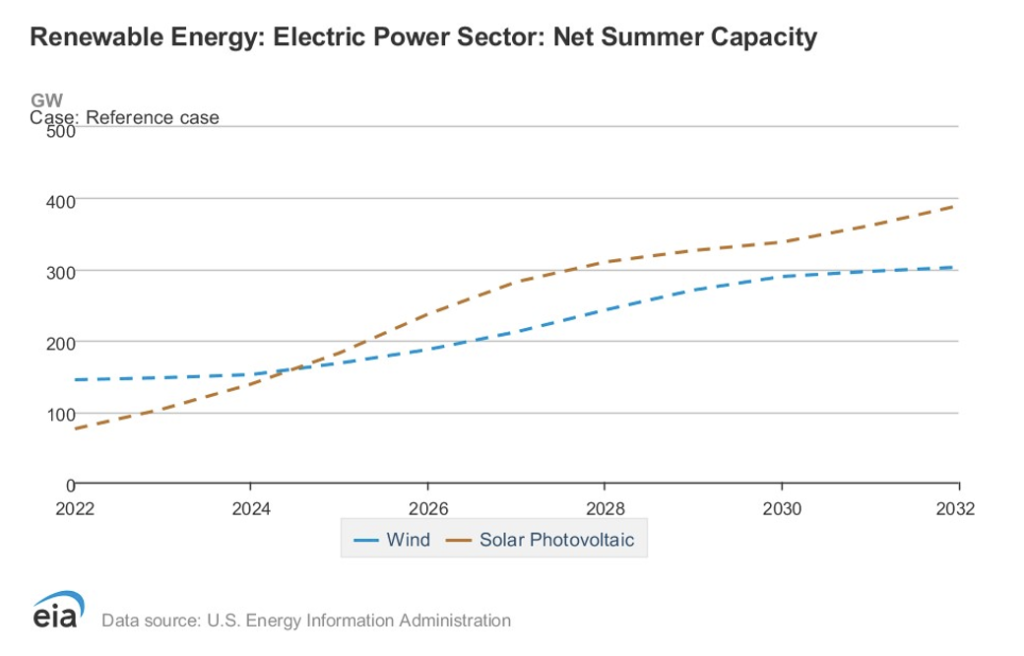

The ITC market grows as a percentage of renewable energy investment. The base percentage is typically 30% of project cost, with a +10% bonus if built with domestic content and a further +10% bonus if sited in an “Energy Community.” Some small-scale solar developments qualify for additional ITC bonuses: (1) a +10% bonus for projects in low-income communities or (2) a +20% bonus for low-income housing projects.

The Energy Information Administration (EIA) forecasts solar and wind power in the US will roughly quadruple and double, respectively, over the next 10 years.1 Given EIA estimates of the cost to construct solar and wind power, the US is likely to invest over half a trillion dollars in renewable energy over the coming decade.

A profitable ESG initiative

With an increased focus on ESG investing, ITCs present a unique opportunity for corporations to do well while doing good.

“Purchasing an ITC is a ‘free lunch’ for any eligible taxpaying corporation,” added John Sinclair. “Decision-makers need to understand there isn’t a trade-off here. Buying an ITC is both environmentally responsible and highly profitable.”

How to get started

“For a first-time buyer, the ITC market can seem overwhelming,” acknowledges Ian Clark, Advisor at Bellus Ventures. “The Bellus value proposition is that we make the process easy. We have a deep bench of experienced professionals, a broad network of vetted developers, and we can structure the right deal for every buyer.”

For more information, contact Bellus Ventures at ITC@bellusventures.com.